13 Genius Money Hacks To Get Your Finances Back On Track

For most people, there never seems to be enough money left before the next pay check comes in. The price of everything continues to rise and it seems like every day there is something we have to pay for. This was my issue years ago, until I learned a couple of money hacks that helped me get a better hold of my spending habits.

If this feels like you too, don’t worry you’re in good company.

Here are 13 money hacks I’ve learned throughout the years that your wallet will thank you for mastering.

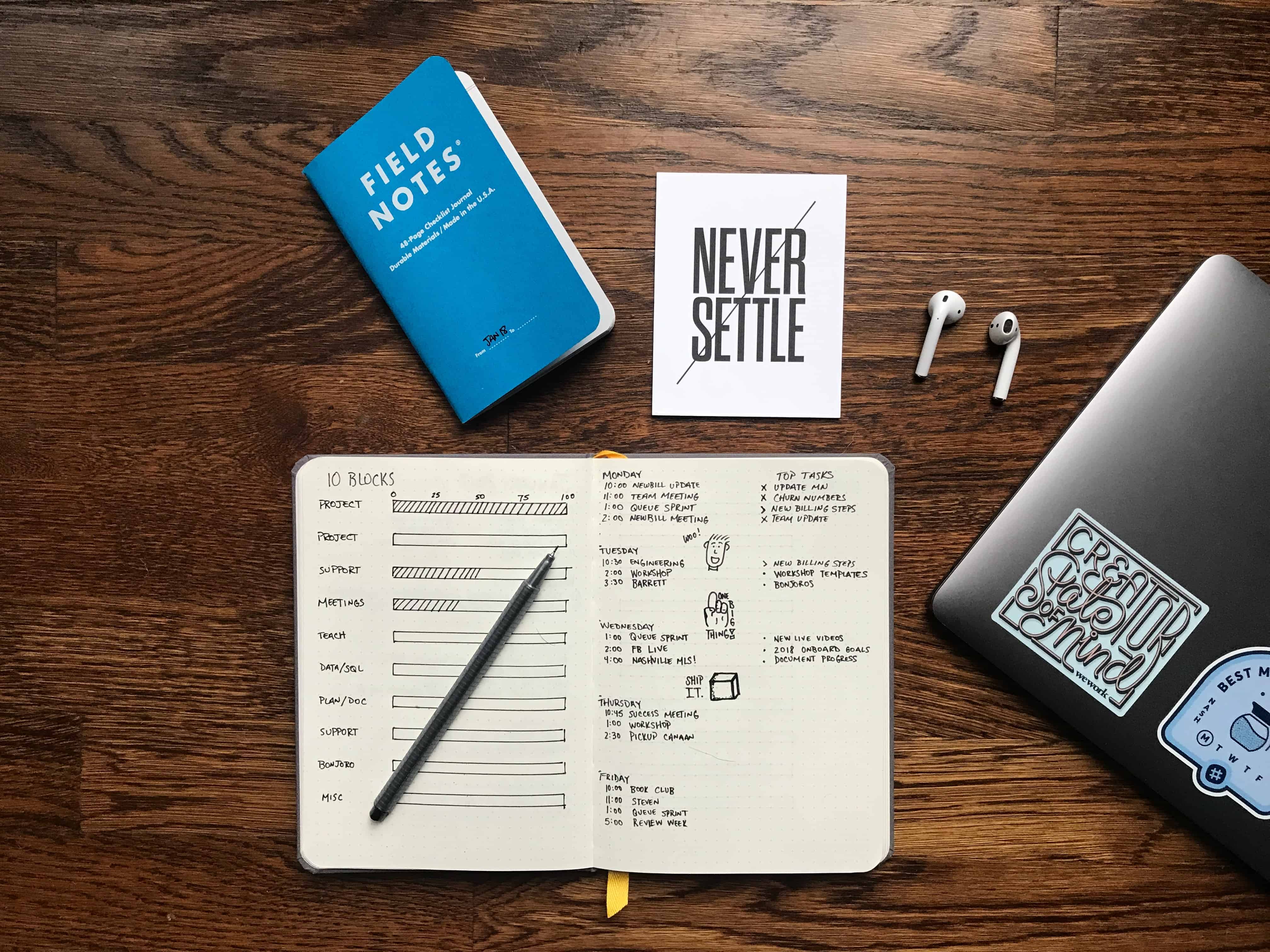

1. Make a Budget

This is probably the last thing you want to hear when you find a money hacking article but it is honestly the task that will put everything into perspective. Most people have issues with money because they don’t look at how they are spending it. You might think you know what’s going where but it is so easy to burn through your cash when spending a little here and a little there. The first step is determining a financial goal. What is it you want to happen in your financial life? For most people it’s being able to save some money so figure out how much of the money that you bring in each month you want to be able to save.

READ: 19 Ways to Simplify Your Life In The New Year

The next step is to write down what you bring in and what you spend each month. Be honest here because if you aren’t, the budget won’t work. Write everything down from the essentials to the stuff you don’t need. Once you do this, you’ll find it is much easier to get a bird’s eye view of where your money is going, what you have to keep in your budget and what can potentially be cut out.

Here are some great tools I use to help you get started:

- Qapital: It’s not exactly a budgeting app but a savings tool. Helps you put money away to save by automatically harvesting the change each time you swipe a linked card. With goals, you can supercharge your savings with minimal effort. I’ve already saved over $500 since using this app for 7 months.

- Mint: The app automatically updates and categorizes transactions, creating a picture of spending in real time. Also comes with a free credit score!

- EveryDollar: It helps you create a monthly budget so you can achieve your money goals.

2. Use the 50/20/30 Rule

The 50/20/30 rules (also known as the 50/20/30 budget) is a type of income budgeting strategy. This one is a little more sophisticated than a basic budget where you write down who much you make and how much you spend.

This type of budget can help you allocate your funds so that it’s a little easier to accomplish your financial goals.

This is how it breaks down:

-50% Goes to Essentials

The first 50% of your income goes to essentials or the things you absolutely have to pay no matter what. Obviously depending on how important any given expense is to you, that could encompass virtually anything but we are talking about the basic necessities a person needs to have.

This includes things like your food, housing, vehicle payments and insurance, etc. Figure out what the must-haves are in your life (and again be honest with yourself). For instance you might absolutely love to watch your favorite shows on cable but cable is sadly not a necessity. You might love the freedom of driving your car but if you don’t need it to make money at your job, it’s not a necessity. Get the picture?

– 20% Goes to Savings

Pretty straight forward here. 20% of your monthly income should go directly into a savings account. If you’re already taking out 20% of your income to sock away in a retirement account, that works too.

-30% Goes to Personal Spending

This is the discretionary spending on stuff you want but don’t need every month. For instance if you like to buy fancy coffee, if you like to shop for stuff that you don’t really need, or if you like to donate money to your favorite charity; that’s all discretionary spending.

The idea behind this budget is that when you divide your money up, you quickly see how much you have for each of these categories. That’s a much clearer picture than when you take money from one big pot every month.

You might find out that you don’t have enough for necessities and personal spending without dipping into savings.

3. Avoid Eating Out

Eating out is easily one of the biggest strains on a budget especially if you have children. Depending on where you live, a family of four can easily burn through 20-30 dollars per meal time when eating out. Multiple that by even just a few times per week and you are spending a few hundred dollars per month on food on top of whatever groceries you are also buying.

An easy way to stop yourself from destroying your budget by eating out is to set the number of times you do it each month. For example resolve to only eat out 2 times per month and pick which days those will be.

By making things predictable you can plan better and avoid surprises. This brings us to our next tip, planning your meals.

4. Plan Your Meals

You can tell yourself all day long that you are never going to eat out again but if you don’t have a plan, it’s even easier to fold and say ‘oh lets just get a pizza’.

Planning your meals helps you avoid eating out and it also helps you budget your grocery money each month as well. Just like with a lot of money budgeting tasks, meal planning doesn’t have to be a big complicated job. Start by doing it a few days to a week in advance. Pick the meals you are going to have for breakfast, lunch, dinner then build your grocery list around that.

Money saving advice: To cut down on my food spending, I signed up for the $5 Meal Plan so I can eat more at home. It’s only $5 a month and you get meal plans with the exact shopping list you need to create the meals. Each meal cost about $2 per person. When you sign up through my link, you’ll receive a 14-day free trial.

5. Optimize Your Costs

Take a look at your monthly expenses that you have to pay. For instance your energy bill, your car insurance bill, your car payments, and other monthly expenses that are pretty much set in stone are all candidates for negotiation.

Pick the ones you know you can influence and see what you can do to lower them. Car insurance is a prime example. You can shop around for car insurance to find a better rate. You can ask your current carrier if there are ways for you to get a discount like by having a car alarm, by increasing your deductibles or rearranging your coverage in another way.

Even if you can only lower a few of your bills by 10 or 15 dollars per month, every little bit helps.

6. Monitor Your Energy Usage

This is a monthly expense that deserves closer inspection in terms of lowering costs. Energy consumption is something we don’t always think about but that costs us a ton of money every month. Find ways around your home to save on things like electricity, natural gas, heating oil, etc.

Get energy efficient LED lights, make a habit of turning off lights and appliances when they aren’t in use, keep your heat/AC at minimal levels when you aren’t at home and look into better insulating your home or apartment. Many small tweaks can add up to big savings.

7. Defer a Car Payment

This is another monthly expense that you can look at optimizing. Deferment is not recommended as a regular strategy as it lengthens the term of your loan or lease but if you need a little extra cash in one month, many loan and lease officers will allow you to move one or more payments to the end of your loan.

Of course you have to be in good standing with your lender and this isn’t a good strategy to get in the habit of using more than once but it can get you some quick cash for the month if you need it for something else.

Money-saving tip: If you need to get a handle on your student loans, car loans, home loans or any other debt, I highly recommend you check out Credible. It’s the only company I trust for lowering interest rates on loans.

8. Refinance a Vehicle

A better strategy to improve your monthly cost on a car is to see if your lender will renegotiate the terms of your loan. Your credit may be in a better position than it was when you first got into your auto loan and if it is, you might be able to refinance for a lower rate.

9. Refinance a Home

If you have a mortgage this is a prime monthly bill that can be targeted for reduction. Refinancing your loan can potentially save you thousands of dollars per year in interest charges. Just like with your auto loan, you may have a better credit position than you did when you first got the mortgage.

10. Turn Old Items into Cash

A quick way to get some extra cash in your pocket is to sell stuff you don’t use any more. If you have old clothes, electronics, appliances, and similar items, you can sell them for cash on sites like Facebook or Craigslist. There are also a ton of apps for mobile that allow you to sell used stuff.

Recommended Sites

- Letgo – Sell items locally

- Poshmark– Buy and sell fashion

- Fashionphile– Sell your handbag

- Thredup– Online thrift store

- Tradesy– Sell anything in your closet

Recommended Apps

- Mercari – The flea market app

- OfferUp – Sell large household items locally

- Gone– See electronics you no longer want

11. Buy Seasonal Stuff off Season

Shopping for seasonal things like holiday decorations or swim wear is often a necessity but you can save money on them. Look for deals right after these seasons end. Stores often sell items for 50% to 80% off retails after seasons end in order to make way for new merchandise.

12. Use Coupons

Coupons are still a great way to save some cash on a regular basis. A good strategy is to sign up for your local grocer’s frequent customer plan (it may not be called this but a lot of leading grocers have them). These are loyalty plans that allow you to save cash the more you use them.

Here are some sites to get free discount coupons:

13. Drink Your Coffee at Home

We totally get it, the fancy coffee at your trendy café is way better than the junk you brew at home but if you’re willing to make the sacrifice, making your own coffee can save you a bundle.

The daily coffee trip, otherwise known as the moca-effect, is a popular scape goat for killing budgets. While it might not help a ton, brewing your own coffee at home can save you at least 3 dollars each time you would have otherwise gone to Starbucks.

Invest in a good coffee machine. Keurig has a good line of coffee machines. The one I own, cost less than $100 bucks and brewing K-cups can save you about $3 per cup of coffee. They run about $12-$15 for 24 kcups, which would be 50¢ to 63¢ per cup of coffee.

Bonus: Start A Side Hustle

Wouldn’t it be so much easier if you had an extra $500 – $1,000 per month coming in from a small side hustle? You could pay off your debt sooner, add more to your emergency savings, or even stash some cash away to take that extra vacation you’ve been wanting to do without having to put it on a credit card.

There are several side hustle options out there, but starting a blog is my top side hustle recommendation right now.

Why?

Well…it has a low barrier of entry, you can set it up in 15 minutes, can work from home or anywhere if you have a laptop, and have the potential to make a full-time income with it. I currently make between $6000-$10,000 a month (see my latest income report here) from blogging but it didn’t happen overnight.

You can create your own blog here with my easy-to-use tutorial. You can start your blog for as low as $3.95 a month and you’ll get a free domain if you sign up through my tutorial. I have a free blogging course you can join too that will help you start and launch a successful blog with ease!

Conclusion

Ultimately, all budgeting and money saving strategies are about sacrifice. There are expenses and necessities you can’t avoid but to accomplish your goals, sometimes you have to forego the near term things you want.

5 Comments